Information Regarding the Payroll Authorization Form

Note: The Payroll Authorization Form (PAF) should be used primarily when payment is being distributed across FOAPs. All other individual payment types should be processed as a One Time Payment (OTP) in HRMS.

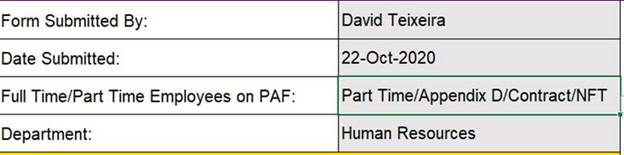

1. What information must be provided on the (PAF)? The user must first complete the “Form Submitted By:”, and “Date Submitted:” fields, indicating whether the (PAF) is paying Full-Time or Part-Time/Non-Full-Time employees, and then the Department. This will then open up the payment information area. In these fields, the Reason for Payment must be selected from the drop-down menu. The employee’s name, employee (person) number, active assignment number, date of payment, rate of pay (unless the Reason for Payment is overtime), and FOAP must also be included.

Screenshot of the PAF form. The following fields appear “Form Submitted By: David Teixeira”, “Date Submitted: 22-Oct-2020”, “Full Time/Part Time Employees on PAF: Part Time/Appendix D/Contract/NFT” and “Department: Human Resources.”

2. Can multiple employees be entered on one (PAF)? Yes, this is encouraged. It is okay to use different rates of pay and/or different FOAPs as well.

3. Can I use multiple reasons for payment on a (PAF)? Yes, as of October 2020, you can use multiple reasons for payment on one form.

4. Can I pay both full-time and part-time/non-full-time employees on one (PAF)? No. Unfortunately, a (PAF) can only be used for either full-time or part-time/non-full-time employees, but not both.

5. What date should be entered in the Date of Payment column? The date of the payment should occur when the employee’s assignment number is active. If a date is used when the employee does not have an active assignment, the employee will not receive pay.

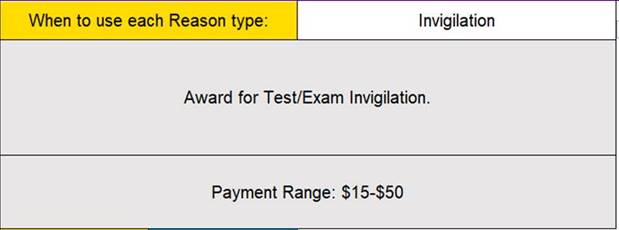

6. What rate can I enter for each Reason of Payment? Each reason has a corresponding rate or range of rate (see screenshot). Rates must fall within this range or HRMS will not pay. This is to ensure equitable pay. If you’re not sure what the rate should be, reach out to your HR Business Partner or Talent Acquisition Advisor.

Screenshot of the PAF form. The following fields appear: “When to use each Reason type: Invigilation – Awards for Test/Exam Invigilation; Payment Range: $15-$50.”

7. There does not appear to be a reason that corresponds with why we would like to submit a payment. What should we do? Reach out to your Talent Acquisition Advisor to determine if the (PAF) is the best way to submit the payment. If it is, we can look into adding that reason to the (PAF).

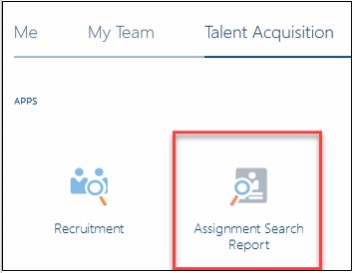

8. How do we find an employee’s person number and assignment number? From the HRMS homepage, click on the Talent Acquisition tab, then select Assignment Search Report. When the report opens, enter the employee’s name. View a step-by-step guide on how to access the Assignment Search Report.

Screenshot of the Talent Acquisition tab in the HRMS with the “Assignment Search Report” icon highlighted.

Employees can find their person number and assignment number, by clicking on the Personal Information button once they are logged into the HRMS. View a step-by-step guide on how employees can access their Employment Information.

Alternatively, managers can access this information via the My Team tab on the HRMS. View a step-by-step guide on how to find mandatory employee information (such as person and assignment number) on the HRMS.

9. The person who needs to be paid is not a Humber employee, so they do not have an assignment number. What should I do? Contact your Talent Acquisition Advisor. They can assist you in determining how best to pay this person.

10. What is the purpose of the ‘When to use each Reason type’ area? This area is for information only and does not need to be completed. Here you can find when to use each type of payment, the accepted range of rates that can be used, and a calculator to look up specific rates for employee types. If the rates appear to be out of date, please contact the Total Rewards team (totalrewards@humber.ca).